What is the price that is actually paid or should be paid for goods sold into the EU?

This is the central question when determining a customs value according to the Customs Code.

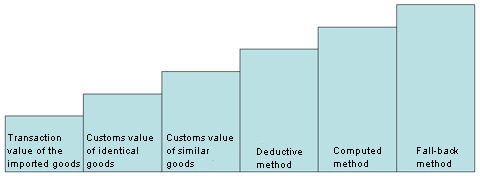

In order to cover all conceivable possibilities arising in international trade when determining a customs value there are, in addition to the transaction method, five other methods that must be applied successively. The initial step, however, consists always in determining whether the first method of valuation (transaction value of the imported goods) is applicable. The literature dealing with this step-by-step examination speaks of a customs valuation ladder which must be climbed rung by rung until a successful outcome - determination of the customs value - has been achieved.